CTA TSMOM¶

Backtest Data and Methodology¶

As we compute a market anomaly for Time Series Momentum, which is different than the Momentum in finance literature, as documented by Jegadeesh and Titman (1993), we establish strong relationship of securities returns with its past returns. We start with 54 continuous futures contracts covering

Equity Index Futures

FX Futures

Bond Futures

Commodity Futures

For our Levered positions, we use the scaling factor of \(\frac{20\%}{\sigma_{t-1}^s}\)

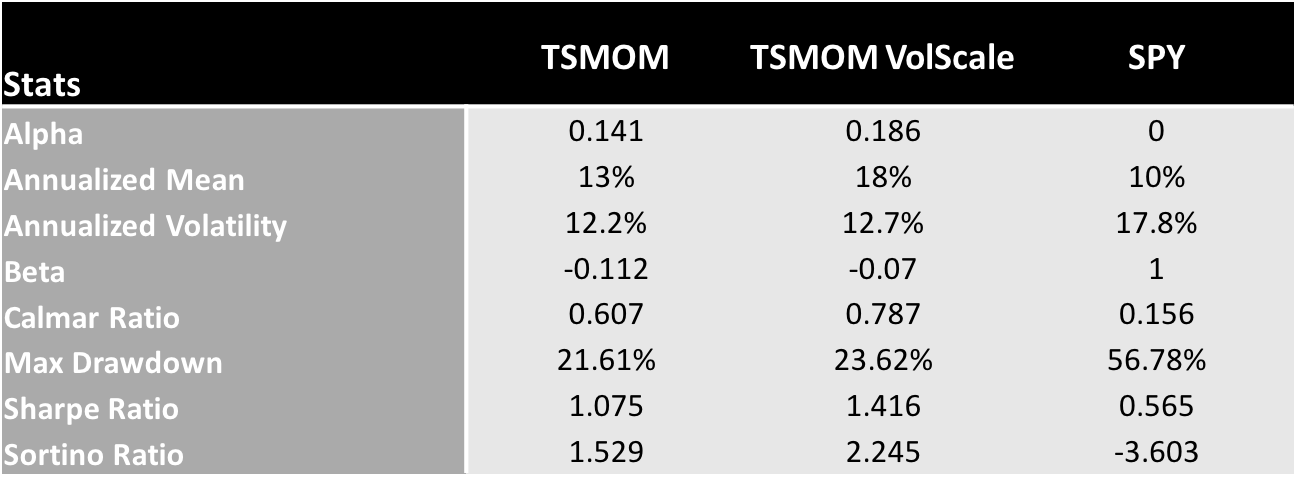

Results¶

We provide the interactive plots and data below, along with summary statistics.

Summary Statistics